Digital Cash In A Cashless World

Undoubtedly, the outgoing year will come to history as the time of numerous notable, yet seldom, harrowing events. We all could witness the beauty of the Rio Olympic Games, we all followed the US Elections back in early November ending up in a surprising win of Donald Trump or the Brexit referendum in the UK. There were also immense scientific achievements like the successful mission of the Juno spacecraft or The Falcon SpaceX project lead by the great inventor Elon Musk. On the other hand, we witnessed frightful moments, naming only a few of them, the spread of the terrorist attacks across the Globe (Belgium, the USA, Germany, Nigeria, Turkey, Syria), a breakthrough of the Zika Virus in Brazil or operations against ISIS/ISIL in Syria and Iraq. These are definitely the life-shaping stories, but there is yet another matter that has not been covered by the media with required thoroughness and fullness – the ongoing World’s cashless revolution.

India?s Demonetization

The 8th of November 2016 was a remarkable day, not only because of the election of Donald Trump to take office as the 45th President of the USA on the 20th of January 2017 but also due to the Demonetisation Act in India. The decision was announced by the Indian Prime Minister in a special TV audition. The news struck like a lightning. Without any previous announcement, the Indian government withdrew 500 and 1,000 INR banknotes from the use. A sudden change in the course of events indicates that the chosen date was not a coincidence. The situation is clear, the whole monetary revolution has been happening without greater media?s publicity. It is estimated that 86% of all India’s cash in circulation were stored in that type of bills. The aforementioned notes had to be replaced before the end of the year and if it wasn?t, it would be illegal to use it. At the same time, issuance of the new 500 and 2,000 INR banknotes of the Mahatma Gandhi New Series in exchange for the old banknotes was declared. The Prime Minister?s of India administration has officially stated that the actions are in response to the black market and drug lord payments, reducing counterfeit cash which has been used to fund the terrorists, and to fight the rising level of corruption (India is 79th in the Corruption Perception Index – lower than many undeveloped African countries like Lesotho and Burkina Faso).

Assuredly, the motives sound to be rational and justifiable, however, the case gets much more interesting once we dig deeper into it.

According to information from income tax probes, black money keepers store only 6% or less of their crooked wealth as direct cash, therefore aiming at this cash may not be a victorious approach. It might remind the Ancient story of the Sisyphean labor. Citizens were given only 7 weeks, bear in mind that India is a 1.3 billion country, to tender all of their money in either the Reserve Bank of India or commercial bank branches. In the meantime, the government set several official restrictions on withdrawing new banknotes from the ATMs and banks across the whole country. The limits had been changed numerous of times before the last were fixed at 24,000 INR per week from 14th November (financial institutions), and denominations would allow a maximum withdrawal of 4,500 INR per day (cash machines). Indian taxpayers that were abroad at the time were not given a chance to change their money before the set deadline, leaving many of them with the savings in invalid banknotes. Moreover, the possession and transferring the banned notes was seen as a punishable offense and could end up with a fine of 10,000 INR.

The Indian society was immediately divided by the government’s decision, the Opposition parties expressed their deep concerns regarding the demonetization resolution. In effect, it led to the heated debates in the Parliament houses. On 28th of the November, several of the public demonstrations took place in order to show disagreement with the Narendra Modi’s political direction. People gathered in front of the banks and state buildings demanding to get their money back. What is more, some of the prominent economists, e.g. Steve Forbes or Paul Krugman, made a clear statement of being against the reform. On the other hand, the founder of the Infosys IT company, N. R. Narayana Murthy, or Jyrki Katainen, Vice-President of European Commission, clearly backed the move.

The Aftermath

The first days when the new law started to act officially, the whole country had to cope with significant cash shortages in the commercial banks and ATMs, which were being emptied instantly and became inoperable. Frustrated Indian citizens had to spend long hours in huge queues just to exchange or withdraw their own money. Many of the local businesses, where only cash payments are allowed, were paralyzed and unable to offer their services. A lot of truck drivers were having trouble to pay the highway tolls since the were not able to obtain enough cash in the requested banknotes. Initially, the Indians were trying to get protected financially against the ongoing events by exchanging their money for alternative forms of storing the capital for either gold or cryptocurrencies like Bitcoin. Precious metal prices’ had been up 30% in the whole country, however, later on, the limits on gold purchases and kept in custody were introduced. From the 1st of December, married women were only allowed to own 500g of gold, where unmarried could only to keep half of that amount. All men, indifferently married or single, were permitted to have just 100g of the golden ore. The Bitcoins have been linked to a black money market, and its use has been not advised by the government. The Reserve Bank of India officially stated:

?The creation, trading or usage of VCs including Bitcoins, as a medium for payments are not authorized by any central bank or monetary authority. No regulatory approvals, registration or authorisation is stated to have been obtained by the entities concerned for carrying on such activities. As such, they may pose several risks to their users?

Moreover, India Today TV station broadcasted nearly 10 minutes long video which clearly showed the cryptocurrency in a very bad light.

https://www.youtube.com/watch?v=Xn6IOaP39yQ

As an immediate effect of the turmoil with withdrawing the money, more than a hundred people have lost their lives. Many of them died while being stuck in the long queues while for their turn to the ATMs. What is worth mentioning is the fact that some of the fatal casualties have been linked to the suicides. In practice, the whole procedure will end up that the cash supply will be insufficient to fulfill the needs of the citizens, effectively pushing them to use the new digital means of payments. Various studies confirm that theory.

Less-Cash First Cash-Less Next

At the same time, to resolve the cash shortage crisis, the government provided the residents of India with new cashless digital payment systems like: AEPS (Aadhaar enabled payment system), USSD (Unstructured Supplementary Service Data), UPI (Unified Payments Interface), Micro ATMs, mobile wallets and a few others. The main application that has been introduced is called E-Aadhaar and requires an Aadhaar number (Personal Identification Number) and a fingerprint scan to initialize the payment process, the below elements make it possible to use the tool by every individual, regardless of not having a smartphone or a PC.

@stpipune officials at #DigiDhanMela @UIDAI stall in Goa #GoCashlessGoDigital #meradigitalindia

@rsprasad @ppchaudharyMoS @cashlessgoa pic.twitter.com/dEdqXm6I90— STPI Pune (@STPIPune) December 28, 2016

It is worth pointing out that India has one of the biggest biometric identification systems in the world with around 1.1 billion registered citizens (registration is mandatory). It is not a secret that one of the goals is to completely eliminate transactions anonymity. With around 99.5% population over 18 years old having Aadhaar card it is a realistic and relatively simple goal to achieve. The official governmental program to encourage Indians to use the below arrangements was launched and began to be promoted in the mass media.

Focus on only withdrawals main cause of long queues! Keep #Currency in circulation! Adopt #Digital transaction! Problem will vanish soon! pic.twitter.com/orhrZLRGDh

— Parimal Nathwani (@mpparimal) December 15, 2016

Unquestionably, the Modi’s administration is aiming at implementing digital cashless environment in a quick fashion and on an unprecedented scale. In order to educate the society about the new electronic means of payments, the number of workshops and meetups were organized addressing a variety of social groups.

Cadets in Tamil Nadu were trained by @CSCegov_ on various modes of digital payments. #DigiDhanAbhiyan pic.twitter.com/q5IMimdBYo

— Ravi Shankar Prasad (Modi ka Parivar) (@rsprasad) January 14, 2017

To incentivize and support the users of the brand new technology, the officials have been awarding them with the money prizes (transferred digitally – of course). For the Christmas, 15,000 people could win a 1,000 INR grant on a daily basis. Also, the Bumper Draw was proclaimed to be held on 14th of April to reward the Indians for their patience, cooperation, and prolonged inconvenience. There have also been several of tax reliefs for utilization of the digital payment systems.

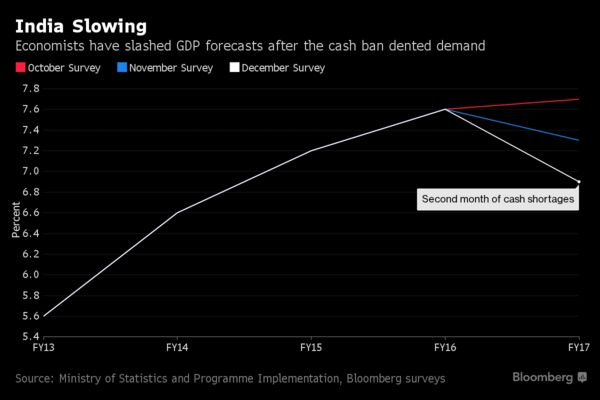

From an economic point of view, the GDP of India is expected to lose the solid portion of its dynamics due to the latest monetary reform. Each sector of the Asian powerhouse country is going to grow less than expected, including manufacturing, agriculture, construction, trade, telecommunication, and mining. The Indian Stock Exchange Indexes, BSE SENSEX and NIFTY 50, went down significantly in the effect of the US Elections and the demonetization act.

The Ongoing Cashless Revolution

Even though it might seem like the cashless revolution in India is something uncommon, in reality, it unquestionably is not. All over the world, there are countries that have been making the attempts to switch to digital payment technologies. The leaders of these kinds of solutions are located across the whole globe Australia, Asia, Europe, and the North America. The Australian firms and its government have been very active in late efforts to expand the blockchain-like technologies use. There is an official plan to stop using coins and bills by 2022, making Australia a fully cashless economy. Elliot Smith, Head of the Westpac Bank, told the press that:

“Cashless technology is the way of the future. Customers are at the heart of our business and we are committed to technological innovation and cashless options to make customers’ lives easier. This includes providing digital offerings such as Cardless Cash, Fingerprint login and tap and pay”.

In addition, there have also been speculations to abolish the homeland’s highest-denomination bill of $100 AUD (it has already happened in Venezuela and earlier mentioned India). The $100 and $50 AUD banknotes, currently, stand for about 92% of all the cash value in circulation. In Europe, as expected, Switzerland and the Scandinavian countries of Sweden, Denmark, and Norway are at the head of the innovation race. Some progress has been also made in Venezuela or Pakistan. Even the World Economic Forum has sparked the debate whether the cash should be still in use, what clearly indicates that there has been a constant trend of removing the high-denominated notes from the distribution.

There is no doubt, that the FinTech world of future will definitely have its foundations built on the cashless digital technology. Even though, the ready cash has been a primary mean of payment for more than 300 years across the globe it now has reached its limit of serviceableness. It is defined as “Cash refers to money in the physical form of currency, such as banknotes and coins.” There are many identified disadvantages of using cash on a macro scale. The physical money is expensive for storing and transporting, requiring a cooperation of conveying firms and utilizing sophisticated safes to provide security. It is also a really vulnerable asset that can be either damaged, stolen or lost. The majority of the bank has to have a treasury house for their money reserves which generate additional costs. What is more, the banknotes are fairly easy to be counterfeited and inserted into circulation. On the other hand, the cash has its own positives sides. First of all, it is essentially anonymous and transferred directly between the parties so it cannot be blocked due to arbitrary reasons.

The introduction of digital banking obviously resolves many of the cash-related impediments. However, it simultaneously deprives it all of the cash benefits, e.g, anonymity, and lack of third party involvement. By switching entirely to the standard digital banking systems the users are obliged to put their trust in financial institutions and the governments. There are numerous threats related to such a status quo. The fiscal policy and applying laws may be changed instantly after the local parliament elections, depending on the winning party program and unexpected decisions. For example, during the 2008 financial crisis, the “Too Big To Fail” banks were bailed-out, regardless of the social disagreement.

Another event worth mentioning is the Cypriot Crisis in 2012-2013. As an effect of the potential default of Greece and a notable downturn in the island’s economy, the drastic measures were introduced. The Bank of Cyprus cut 40% of the deposits over 100,000 EUR.

The recent years we have witnessed, what several years ago was just a science fiction: a birth of negative interest rates that were set by the Central Banks of Japan, Switzerland, Denmark, and Sweden. Unprecedented fiscal policy hit the customers with gradually shrinking savings in the commercial banks because of the negative interest being applied. Once this solution would be introduced as a norm, the clients would turn away from banks to keep their money safe in the alternative locations and investments.

Cryptocurrency Breakthrough

Fortunately, there has been an ongoing development of cryptocurrencies, which are being designed to protect against previously mentioned threats. In 2008 a person or a group of people under Satoshi Nakamoto pseudonym introduced the first implementation of a cryptocurrency called Bitcoin and described it in the whitepaper titled

?Bitcoin: A Peer-to-Peer Electronic Cash System?.

The very first sentence from the document explains precisely the goal of the project:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

The following definition was later formed:

“A cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency. Cryptocurrencies are a subset of alternative currencies, or specifically of digital currencies.”

Units of this new asset class were designed to take the best properties of both worlds; physical cash?s simplicity, anonymity, lack of trusted intermediary and digital world?s speed, reliability and security ensured by the cryptography. It was not a coincidence that the project was released soon after the financial crisis in 2008. As a matter of fact, it was inspired by it. Bitcoin?s creator(s) hid a following message in the system:

?The Times 03/Jan/2009 Chancellor on brink of the second bailout for banks? which refers to ?The Times? newspaper?s article about a questionable plan to save the insolvent banks.

The main objective of the technology is to be free of the government’s interference and to have a supranational character, in simple words, a decentralized currency, globally available for any purpose. Moreover, the aim is to keep the transaction fees as low as possible, often close to 0. Bitcoin is the largest of its kind in terms of total market capitalization, whereas, there is a variety of others like Namecoin and Litecoin. Each month, the number of places that accepts Bitcoin payments is growing noticeably. There is nothing unusual in using that cryptocurrency for the same purposes as standard currencies like Dollar.

We could observe many real life cases where the system proved its superiority over traditional means of transferring monetary values. Just to name one it is worth mentioning that on 7th of December 2010 a financial blockade was imposed on the Wikileaks by the Bank of America, VISA, MasterCard, PayPal and the Western Union. Regardless of the political views, it cannot be denied that the documents leaked by the organization had an immense social impact even on the latest US presidential election results. By being able to block funding of such organizations one can censor the public debate and effectively change the political landscape. Wikileaks bypassed the ban and continued to collect donations by using the Bitcoin address. The incident showed how freedom of speech is limited without a financial freedom.

Distributed Ledger Technology – The Long Way Ahead

Most of the cryptocurrency transactions take place on a distributed ledger, which usually is a Blockchain. It allows to securely transfer digital tokens which can represent almost any kind of objects or value – not only units of a cryptocurrency.

The technology makes it also possible to execute smart contracts, which in practice, enable to develop self-settling securities, self-expiring acts of ownership or even Decentralized Autonomous Organizations (DAOs).

Even though, no central authority manages the distributed ledger (or a blockchain) by itself it can be either public or private. The public distributed ledger is decentralized and permissionless – no one has exclusive control over it. So-called private distributed ledgers are permission and controlled by the limited consortium of participants. The significance of the public blockchain is that it provides a practical solution to the Byzantine Generals problem (formally it is proven to be unsolvable). The problem arises whenever autonomous parties must operate together in a trustless environment to achieve some collective goal. One of the most important components of a solution proposed by Satoshi Nakamoto is a computationally intensive consensus algorithm called Proof of Work. A certain amount of computing resources must be spent in order to produce a valid block of transactions which can be later linked to the chain of previous blocks (blockchain). The algorithm self-adjust its difficulty targeting 10 minutes per new block on average regardless of the computing power of the whole network. On the other hand, checking if a given block is valid is instantaneous. The process of adding new blocks in called mining. Nodes of the network consider transactions as valid if they are in the longest chain of blocks. Bitcoin solves the Byzantine Generals problem under the assumption that the attackers control the minority of the network?s computing power which means that they cannot compute the longest chain. Participants of the system are incentivized to act honestly by being able to collect new coins as a reward for mining new blocks and collecting optional transaction fees.

In the USA the R3 consortium was set up in 2014 to propel the private Blockchain advancement, the group consists of about 70 IT and Financial widely recognizable corporations like IBM or State Street. DTCC (The Depository Trust & Clearing Corporation) announced that they selected the R3 group, IBM, and Axoni to develop their own distributed ledger system. The American company is, by far, the biggest clearing house in the USA, serving as the one main post-trade operators in the world. The works are scheduled to start by the end of January 2017, and the first implementations should come to life by the end of 2018. Seemingly, the first ever foreign interbank Blockchain transaction was conducted between the Wells Fargo and The Commonwealth Bank. The subject of the trade was a payment for cotton delivery from Texas to China; the electronic letter of credit was issued on the digital platform making it possible for all parties to the track the deal simultaneously. The Swiss government, together with the local firms, has been performing advanced tests of the Bitcoin-based payments Since November 2016, it has been possible to buy Bitcoins from the ticket machines owned by the Swiss National Railways (SBB). Also, the Central Bank of Switzerland has released various positive opinions regarding the future implementation of the innovatory technology on a larger scale.

Coming back to India, the latest press release of the Reserve Bank India indicates that the country might take its course to the Blockchains as well. Two years ago, the Working Group (experts from RBI, IBA, NPCI, CCIL, ISI, State Bank of India, Punjab National Bank, Bank of Baroda, ICICI Bank, HDFC Bank, Axis Bank, Citi Bank, Deutsche Bank, Infosys, TCS, IBM Research, Deloitte and MonetaGo as members) was established. The newly published white paper describes potential use of the technology in the Indian financial and banking sector. Definitely, more update to follow soon by Institute for Development and Research in Banking Technology.

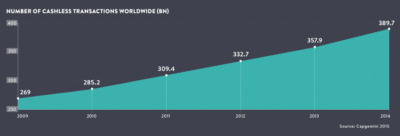

The economists are aware that the electronic banking sector systems development is necessary, the numbers of trading activities are significantly rising day after day. Even though, the physical cash has been a primary mean of payment for more than a 1000 years across the globe it now has reached its limit of usefulness. Blockchain, being a fairly new technology, has not gained much of broader recognition in the eyes of a broader audience so far. However, it has its major challenges for going mainstream identified perfectly. There is still a huge amount of development work ahead until the fully operable systems would be available on a larger scale. Also, the governments need to set the proper regulatory frameworks to let the cryptocurrencies and blockchain exist as the legal mean of doing business.

Theoretically, blockchain and the cryptography it uses is extremely difficult to hack, but there should be months of additional testing to prove it so, what is more, a proper workaround, if something goes wrong, should be stated and verified to avoid incidents similar to ?the DAO? failure.

From an educational point of view, there is still not enough easily accessed information about blockchain and its potential use for an average person. The official blockchain academic incubators might be highly beneficial to ensure that the technology is understood and learned by the young future professionals. Undoubtedly, the technology is aimed to be firstly implemented for the internal use of financial institutions, nevertheless, it will eventually need to be trusted by the whole society. Accenture has estimated that it will take about another 10 years to finalize the implementation to be in common use.

There are still cybersafety concerns that need to be discussed before the widespread populace will commit their personal data to various blockchain applications. On the other hand, at first glance, the decentralized structure might be one of the to-good-to-be-true solutions for users to put their trust into the outcome.

Indeed, there is a long way ahead of distributed ledger technology and cryptocurrencies to be seen as a norm and an approved arrangement that works silently in the background making our lives easier. There are huge expectations and even bigger commitments to be made, fortunately, we can observe that more and more financial and IT bodies are now looking at blockchain as a huge opportunity instead of a Wonderland imagination. Each implementation of the distributed ledger technology has its advantages and it is often tailored to meet specific industry and regulatory needs. It is crucial to remember the fundamental difference between theirs public and private nature. The digital cash promise can be fulfilled only in the fully transparent and permissionless environment.

Tomasz Kurowski and Tomasz Korwin-Gajkowski