History of Economic Crises. Part 6. Getting Rich through Inflation!

In the previous part, we discussed the economic crisis that took place in revolutionary France. However, it is also worth examining another truly pathological episode in the history of finance. We are referring to the period known as Kipper und Wipperzeit.

Get richer by minting more inferior coins

Among cryptocurrency enthusiasts, it is often argued that metallic money is superior to paper money. This is certainly true, but even in this first “hard” system, one can encounter pathologies.

The term Kipper and Wipperzeit refers to a highly pathological period in the history of economics, which demonstrated that a financial crisis can also occur in a metallic money system.

This phenomenon occurred primarily in the German Empire in the first quarter of the 17th century. The linguistic origin of the name is not entirely clear, but let’s examine what happened during that time.

German princes, clergy, and even the emperor devalued the small coins used in daily purchases (today we would say microtransactions). In practice, they increased the face value of these small coins while simultaneously reducing their weight or using progressively less silver in their production. It is worth noting that this practice never affected the “larger” coins.

Naturally, for the issuers themselves, this meant pure profit. By using less precious metal, they minted a greater number of coins that, as they tried to convince the subjects, were worth more in the market.

However, it is important to ask why they did this. The aim was to prepare for the war (which later turned out to be the Thirty Years’ War) that ultimately broke out in 1618 and lasted until 1648.

Cuckoo’s eggs

Initially, the lower-quality coins circulated only in local markets, within the borders of a particular German principality. However, over time, they began to be surreptitiously introduced into neighboring regions. The coins were transported across the border, exchanged for “healthy” money there, and quickly transported back. In this way, experts or the nobility were not deceived, but rather ordinary people who did not understand the principles of coin minting or economics.

This eventually led to a competition based on who could mint the worse coin. Rulers of regions that suffered due to the monetary actions of their neighbors started minting even worse units of currency to make it difficult for their opponents to steal precious metals from their market. As a result, hyperinflation occurred. Chroniclers recall that during this period, even small children played with the worthless coins, as adults considered them to be of no value.

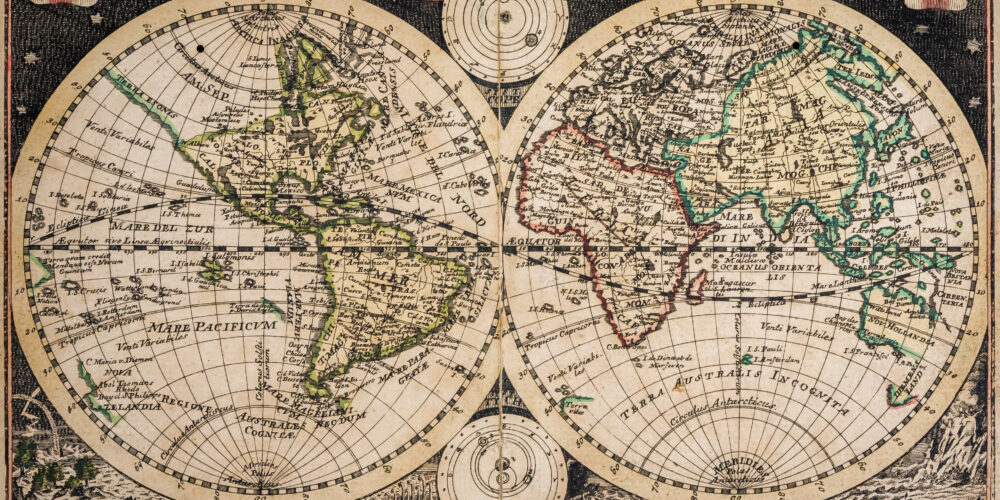

It is also worth noting that this practice spread slowly. It originated in Italy, then was observed in southern Germany, and reached almost universal scale around 1618, precisely during the outbreak of the Thirty Years’ War. Ultimately, the crisis was so extensive that worthless coins appeared in Austria, Hungary, the Czech Republic, Slovakia, Poland, and then, through the actions of merchants, in the Middle and Far East.

To be continued.