History of Money Part 2 – The Fall of Rome

In ancient Rome, the downfall of the empire and the shift in the world order serves as a perfect example of how debt, currency debasement, and inflation can lead to the collapse of an empire.

In the 3rd century BCE, ancient Rome incurred debts to finance wars, and those debts were repaid using plundered wealth. The economy of the Roman Republic was largely based on agriculture, trade in grain and wine. Wealthier families led to the emergence of financial institutions that provided personal and public loans.

S. Krause describes the functioning of the economy during that period: “During times of agricultural and cash shortages, Roman officials typically reacted by minting money, which happened during the prolonged crisis of the First Punic War, causing economic disruptions and difficulties”[1].

Krause highlights the instability of the Roman economy, which was artificially inflated, in part due to propaganda. Emperors spent money recklessly, financing unnecessary projects or wars. War and the expansion of any empire always come with costs. Roman emperors chose to debase the currency by reducing the amount of metal in coins, which were necessary, among other things, to pay for the expanding state apparatus, including the military legions guarding the increasingly lengthy frontier: “The emperors of the Antonine and Severan dynasties generally weakened the currency, especially the denarius, under the pressure of military pay. Sudden inflation during Commodus’s reign damaged the credit market. […] Although Roman coins had long been fiduciary money or trust currency, general economic concerns reached their peak during Aurelian’s reign, and bankers lost confidence in legally issued coins by the central government. Despite Diocletian’s introduction of the gold solidus and monetary reforms, the credit market of the Empire never regained its former strength”.

Furthermore, there were no regulations in place at that time to control the financial system. Money was often transferred on paper without physically exchanging coins. Money without backing is known as “fiat money.” Bankers began lending on risky terms, and the elites were actively involved in the whole process. Banks usually held fewer reserves compared to the total deposits, and the lack of regulations meant that there was no concern about the lack of insurance in case of a bank’s collapse. These and other factors eventually led to the fall of the Roman Empire. This collapse resulted in an economic breakdown and a crisis that affected not only the territories of the former empire but also spread to states in close trading relations.

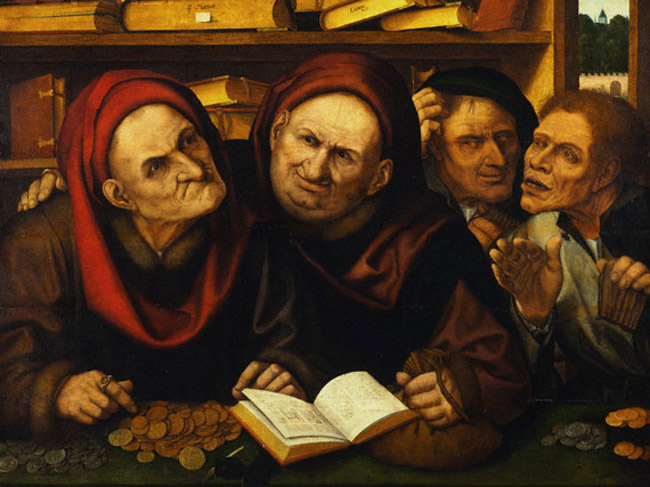

The collapse of the global order led to divisions into smaller, local markets and marked the beginning of the Middle Ages: “A characteristic feature of the Middle Ages is the relatively weak development of commodity-money economy and the fragmentation of the world into many small, almost autonomous economic regions that had only limited contact with each other”[2].

The problem of inflation recurred during the medieval period. In Europe, there was a widespread shortage of gold and silver used for coinage, and rulers addressed this issue similarly to Roman rulers by adding other metals to the coins. Often, there were more metals in the coins than just gold and silver: “The Dark Ages and early Middle Ages were dependent on the Roman Empire for precious metals; they often even relied on actual Roman coins. Eventually, even the art of minting disappeared, along with freshly extracted metal that could be utilized. […] The dependency of early medieval society on the Empire’s coins is perpetuated in many contemporary words, such as ‘sou,’ ‘soldat,’ ‘soldier,’ and the German ‘sold’ (trans. ‘sold’)”[3].

In the next part, we will focus on how money was perceived in the Middle Ages.

_________________

[1] Stanford Mc Krause, Life in Ancient Rome, Brainy Bookstore.

[2] B. Zientara, A Universal History of the Middle Ages, TRIO Publishing, Warsaw 1994, p. 09.

[3] W. Krehm, Meltdown: Money, Debt, and Wealth of Nations, COMER Publications, Toronto 2008, p. 20.