History of Economic Crises. Part 3: The Crisis that Led to the Formation of the USA

You’ve probably heard of the dot-com bubble, cryptocurrencies, tulips, and even the stocks of companies involved in colonial activities. A lesser-known bubble is the one related to canal construction, which led to the formation of the USA…

The first canal that gained wider public attention was the Bridgewater Canal, which connected Worsley to Manchester. Over the course of twenty years, canals with a total length of 16,000 km were built.

But why were canals being built? It wasn’t just a whim but a necessity for coal transportation. The expansion of such infrastructure gave the British economy a proverbial boost. The state supported these investments and allowed canal-building companies to operate under the principles of limited liability (previously granted only to the aforementioned companies in the introduction).

And they lived happily ever after… well, almost…

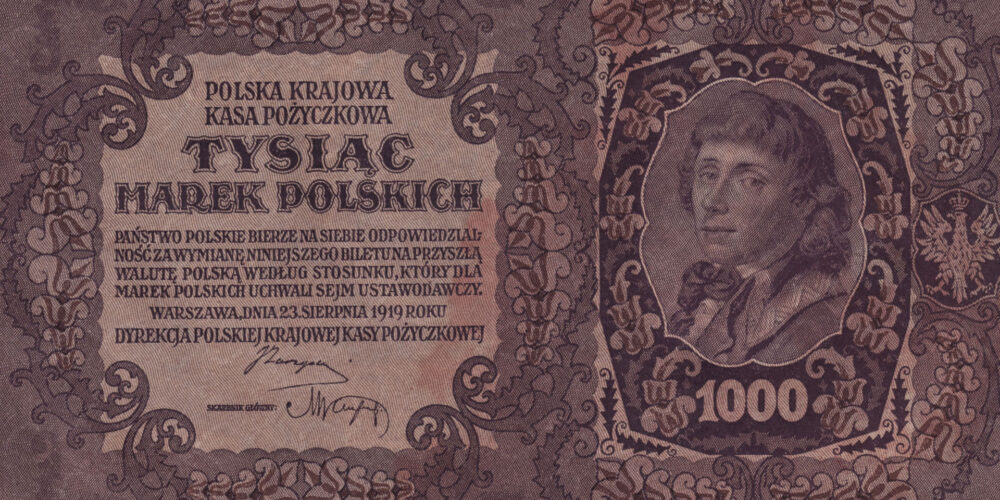

As usual, government interventions combined with the inflationary policies of banks led to another crisis.

Why did it happen? The reasons are quite obvious. Banks were eager to provide loans. The money obtained through these loans found its way into the stock market of canal-building companies, as well as the markets of mining, transportation, and trade. In other words, people borrowed money at low interest rates and then invested it in the stock market or various ventures to multiply their funds.

Various pathological manipulations in the financial market added to the situation. In this case, we’re talking about “bill chains.” One banker issued a bill to their representative in another city, which was supposed to be redeemed after a few weeks. Before the final repayment deadline, the representative of the first banker issued an identical bill, but with added interest. In the meantime, the banker discounted their bill at a local bank and, before the payment deadline of the bill issued to them, issued another bill to their representative in another city. It may sound complicated, but it was essentially a form of artificial and cheap credit.

The Crisis Unfolds

True prosperity cannot be built on credit and constant indebtedness. Ultimately, a bitter punishment awaited the market. In June 1772, a London merchant fled to France to escape his debts. The case became widely known and fueled paranoia (people surely realized that they could face a similar fate if their debtors escaped). This led to a crisis.

However, the situation was even more complicated and dangerous. American planters from the southern states were also indebted to British bankers. When the crisis erupted, banks no longer wanted to accept their bills. Additionally, there was a correction in the prices of colonists’ products, leading to their impoverishment.

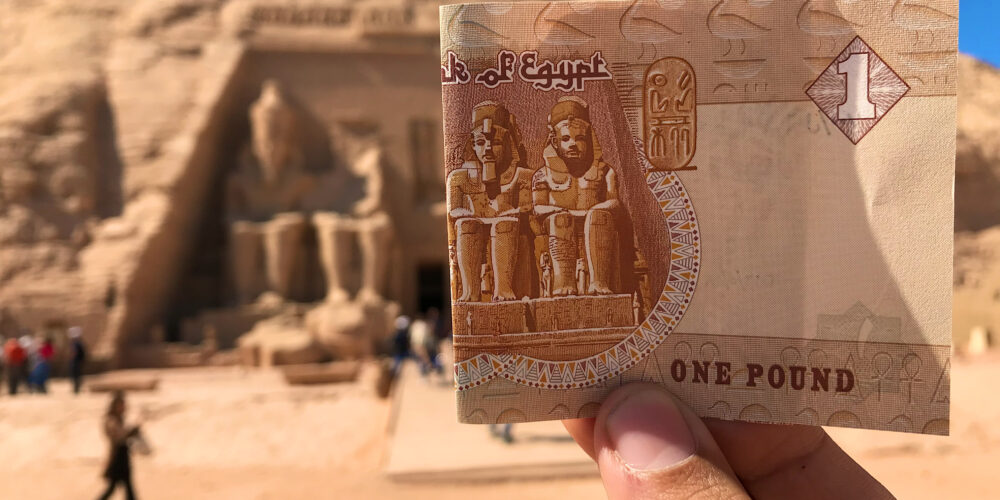

As if that wasn’t enough, the East India Company, a major British trading company, encountered problems during this time. They had purchased significant amounts of tea, which they couldn’t sell. The government decided to intervene and enacted the Tea Act, which allowed the unwanted tea to be sold to American colonists.

The Birth of the United States

It’s not surprising that the whole situation – to put it mildly – frustrated the planters. They responded with aggression, unknowingly giving rise to the future empire. In December 1773, they attacked three ships of the East India Company and dumped all the tea into the sea. We won’t describe the entire cause-and-effect process that followed, but eventually, in 1776, the rebels declared the formation of the United States. However, as it turned out, this was only the beginning of economic troubles…

To be continued.