History of Money Part 3 – Medieval Thinking

Religious reformers Martin Luther and John Calvin, along with other philosophers and clergy members, had their views on money and economics. At the same time, other thinkers analyzed the value of money, the causes of inflation, and the influence of the quantity of metal in circulation. The discoveries and ideas of that era had a significant impact on the development of economic thought.

In the previous part of the History of Money, we wrote about how the downfall of ancient Rome due to debt, currency debasement, inflation, lack of banking regulations, and excessive credit risk led to an economic collapse, division into smaller markets, and weak development of the commodity-money economy in Europe. This serves as a warning about the serious consequences of currency manipulation and the need to make wise decisions for economic stability.

https://webeconomy.info/history-of-money-part-2-the-fall-of-rome//

Today, let’s delve into some philosophy again. Thinking about money began to change once more in modern times.

Luther and Calvin

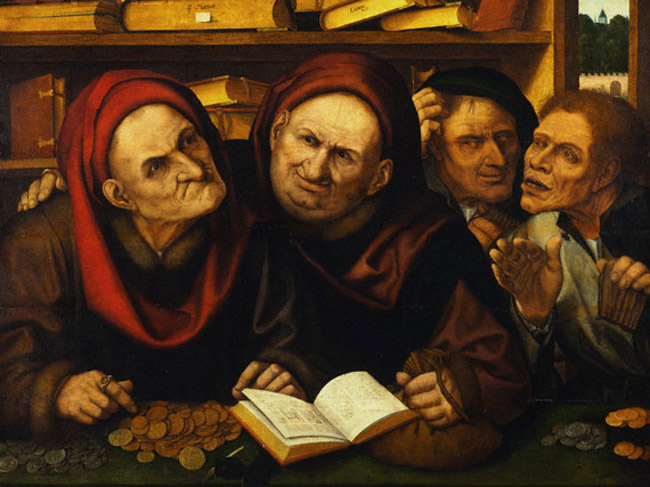

Almost everyone has heard of Martin Luther. However, fewer people know that he had his opinions on money, especially usury. In 1520, he published the so-called “Sermon on Usury.” Four years later, in an open letter to the German nobility, he wrote that usury is the greatest misfortune of his people. He even accused Satan of inventing the lending of money at interest (perhaps someone would use this argument in a credit panel discussion today?).

Filip Melanchthon had a slightly different opinion. Although he generally shared Luther’s views, he believed that money could be lent at interest but only to the wealthy. In short, the rich could be exploited as much as possible, but not the poor!

Jan Calvin was a bit less radical (or perhaps more rational). He believed that interest-bearing loans were acceptable as long as the interest rate was not higher than that set by the authorities. In general, Calvin did a lot of good for entrepreneurship. Although the thesis that religion has a decisive influence on the wealth of a society has long been debunked, it can be agreed that the thinking proposed by the founder of Calvinism did not hinder economic prosperity. His theory of predestination subjected everyday life to strict moral principles and emphasized the cult of work. The wealth of an individual was considered by Calvinists as a manifestation of God’s grace. You have to admit that this is quite a different approach from the Polish thinking that assumes a wealthy neighbor must have “stolen” to be so rich…

Value of Money

Clergy members continued their economic research. During the Council of Trent, the School of Salamanca emerged. Francisco Gracia advocated for the dual nature of the value of money, namely natural value and value derived from “esteem.” He believed that a given coin could have different values in different places, regardless of its consistent quality. Clearer? With a certain number of denarii, you could buy, for example, 10 mugs of beer in France, while the number of mugs filled with golden liquor in Polish territories would double. The differences arose from:

1) Rarity of coins in circulation,

2) Demand for them, and finally,

3) Market security level.

The conclusion, however, was the validity of charging interest. Dominican friar Domingo de Soto, on the other hand, rejected the doctrine of a just price. He believed that the value of a given good was determined by what others were willing to pay for it. He also observed the forces of supply and demand. The value of money also depended on how many coins were in circulation and how many buyers they had.

Martin de Azpilcueta could be considered a proponent of the free market. He also recognized different values of coins as a result of purchasing power. Exchange rate differences, in his opinion, should be fluid due to market changes. Attempts to centrally establish and maintain fixed exchange rates could only cause harm, he argued. Bernardo Davanzati expressed an even more radical view. He noticed that central authorities, by issuing currency, had no influence on its purchasing power. He considered currency a common good and therefore forbade rulers from debasing it (they didn’t listen to him).

What Causes Inflation?

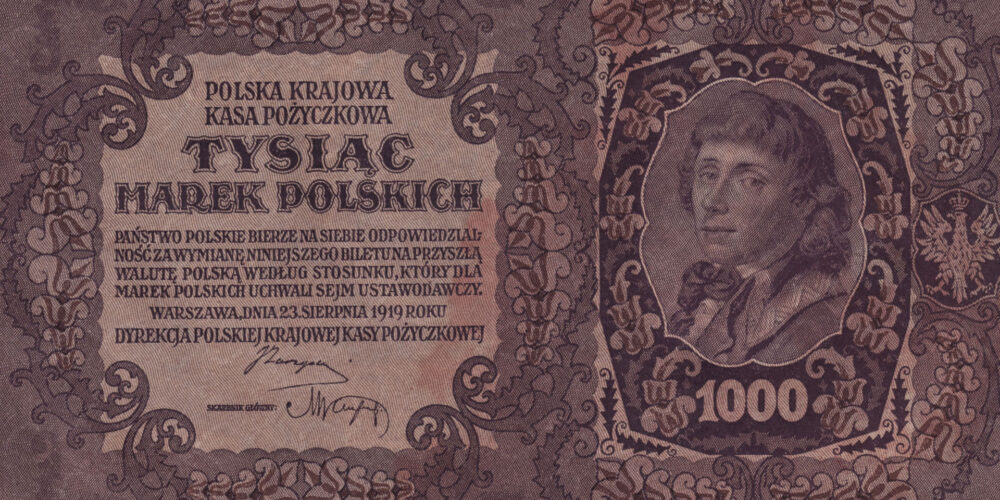

Jean Bodin attempted to answer the above question. He observed that not only debased currencies but also good ones were subject to inflation. The reason? According to him, it was the quantity of metal in circulation.

A significant contribution to the topic was made by a figure well-known to every Polish child, Nicolaus Copernicus. He participated in the preparation of the Prussian-Polish currency union. In 1526, he published the treatise “On the Minting of Coin.” In it, he stated: “A coin loses its esteem, particularly due to an excessive quantity, namely when such a large quantity of silver is minted into coins that people prefer silver in its natural form over the coin.”

Utopias

But why all the fuss about money at all? Can’t we live without it? That’s what Thomas More, the author of “Utopia,” and Tommaso Campanella (“The City of the Sun”) thought. Both of them believed in their utopias that ideal societies could function without money. Well, almost, because coins were still needed for international exchange. However, money didn’t disappear; in fact, it gained importance…