History of Money Part 1 – Barter and Debt

In Web Economy, we have already described the history of economic crises and the history of inflation. We will return to these series, enriching them with numerous interesting facts and discussing more recent history. In the meantime, we invite you to follow a new series of articles focusing on the history of money. This history is closely related to the economic crises and inflationary policies described by us throughout the centuries. As an introduction, let me remind you of some information from the mentioned series of articles.

Crisis

An economic crisis is a sudden decrease in economic activity. Economic crises occur cyclically, as noted by K. Marx, who criticized capitalism, considering it a system destined for crises. However, a comprehensive theory of economic cycles was developed by Austrian economist Joseph Schumpeter (1883-1950), who, as noted by Dr. Krzysztof Piech, “took into account the role of inventions. According to him, innovation is the factor causing economic expansion in the long run. As technology ages, economic growth based on it is depleted, leading to economic stagnation. Unlike Marx’s views, which treated economic depressions as evidence of contradictions in capitalism, Schumpeter considered them neutral (or even beneficial) as they are an integral part of the growth process” [1].

From a libertarian perspective, Nobel laureate Milton Friedman blamed the actions of the Federal Reserve for the scale of the Great Depression. However, every crisis creates opportunities for the development and adoption of new solutions, often innovative ones.

It is an undeniable fact that every crisis brings about changes. The first crises and the changes associated with them were related to climate. In the early Paleozoic era, plants resembled sponges in their structure. There were ideal living conditions for plants due to large amounts of water and carbon dioxide in the atmosphere, so they did not have to compete for resources. This led to an expansion onto land and an explosion of flora in the Devonian period. Unrestrained growth led to a decrease in the level of carbon dioxide in the atmosphere. The plants that had the best chance of survival were those that adapted most optimally to the new conditions. Urszula Zajączkowska describes the anatomical changes in plants: “this is how the personal system of hidden streams, rivers in vessels, dams in roots, came into being. All of this out of hunger” [2].

Thus, a crisis is an element of a cycle. One cycle consists of four waves/phases:

- recovery,

- boom,

- crisis,

- depression.

Just like in the case of plants, crises have shaped the development of human civilization. K. Marx observed these similarities while criticizing capitalism:

“just as celestial bodies, once set in a certain motion, constantly repeat this motion, so does social production, once set in motion, constantly pass through the different phases of expansion and contraction. The effects become causes in their turn, and the varying phases of the whole process, which always reproduces its own conditions, become periodical” [3].

Therefore, the first crises concerning civilizations were related to climate and weather phenomena such as drought, rather than currency exchange. In the Apocalypse of St. John, famine associated with drought is one of the Four Horsemen of the Apocalypse, alongside Pestilence, War, and Death [4].

The economies of ancient civilizations such as Egypt and Mesopotamia were mainly based on agriculture and were thus connected to river floods, such as the Nile, Euphrates, and Tigris. Drought and the resulting famine were not always caused by weather factors; they could also be influenced by human activity, including poor management of canal systems.

Barter Exchange

S. H. Verstappen, in the publication “Thirty-Six Strategies of Ancient China,” describes the problems faced by the Zhou Dynasty in China, which ruled from 1045 to 256 BCE:

“Few people cared about the law; official matters moved forward thanks to money, and court cases were settled through bribery, while chaotic governance harmed the people. From time to time, such actions brought about droughts or floods, and the number of invaders and thieves increased. […] Corruption and slow decay were signs of the approaching end. Shortly afterward, Emperor Wu of the Northern Zhou took advantage of the situation to attack and destroy the kingdom of Northern Qi” [5].

Verstappen also mentions the biblical Horsemen of the Apocalypse:

“At the end of each civilization, three factors come into play: famine, pestilence, and war. If two of these elements appear in a certain place, the third one will soon join them. An ancient saying states that when a tiger is sick or wounded, jackals gather nearby” [5].

The invention of agriculture and the shift from a nomadic to a settled lifestyle played a crucial role in the creation of complex social and economic structures. Initially, in prehistoric times, communities exchanged all kinds of goods and products through barter. W. Ridgeway describes it as follows:

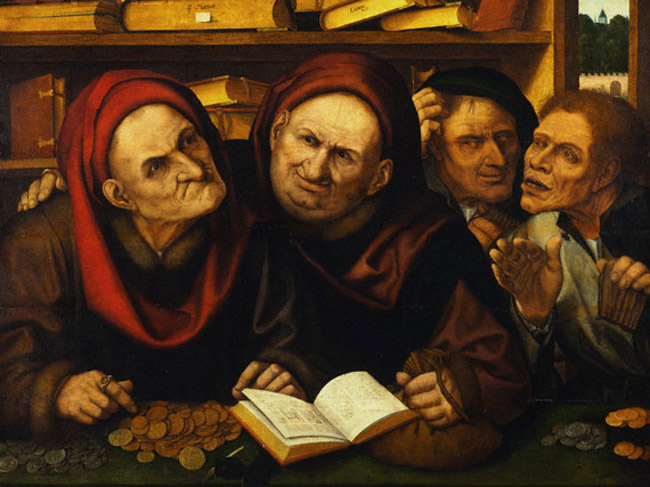

“A man who owns sheep exchanges them for oxen with a man who owns oxen, and the owner of grain exchanges his goods for some tool or metal ornament owned by the latter” [6].

Metals used by the Phoenicians, such as bronze, copper, and iron, as well as precious metals like gold and silver, were treated as a medium of exchange in barter transactions:

“Certain elements typical of primitive currency can be observed in the system of mutual glyphs, in the sense that certain metal objects such as cups, stands, or pots may have value prior to monetary value as a means of exchange, accumulation, or value expression” [7]. Over time, these types of metal evolved into a more convenient form for trade.

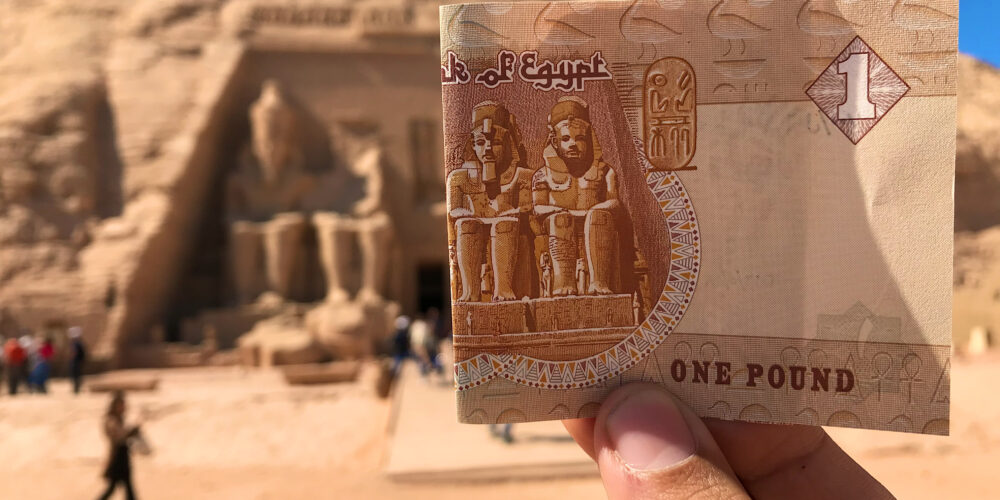

Such metal was not widely recognized as currency. Ridgeway notes that they “did not even have an official seal or government guarantee as to the quality of the metal.” In fact, the form of money used by the Phoenicians may have been adopted from older civilizations: “Early Phoenicians living in the territory of present-day Syria and Lebanon were considered the creators of valuable semicircular (penannular) forms of money, which they likely copied from ancient Egyptians” [8].

However, Egyptians are not considered the creators of money; the Sumerians are generally regarded as its creators: “The Sumerians invented money because their previous system of organizing life had collapsed” [9]. In ancient Greece, initially, non-monetary money was used (such as sheep, goats, and cattle), and metals (gold, silver, and electron, a natural alloy of gold and silver) were initially used in the form of bars [10].

Over time, money became a universal means of communication and a store of value. D. Cohen, in the book “The Captivity of Growth,” points out that money allows for the storage of wealth, just as writing allows for the storage of knowledge. Furthermore, “just like writing, it does something more. It creates a new language, which is also the source of similar misunderstandings” [11].

Debt

Written credit agreements were one of the first uses of writing, including in China and Mesopotamia: “Every era and legal culture had its way of recording debt. The Sumerians drafted debt scripts on clay tablets. The origin of debt in Roman law (within the bond of sponsio) was connected with a solemn verbal exchange of questions and answers between the parties to the transaction using the word spondeo” [12].

The rules of borrowing money were documented by King Hammurabi in one of the world’s oldest legal codes, the Mesopotamian collection of laws that emerged in the first half of the 18th century BCE: “This code uses concepts such as ‘bubullum,’ which means ‘interest-bearing loan, debt with interest,’ or ‘sibtum,’ which means ‘profit, interest'” [13].

The reasons for the first loans in history taken out by states on behalf of society can be traced back to climatic crises and the need to finance wars. The possibility of states borrowing led to the first debt crises. In the 4th century BCE, there was a debt crisis in ancient Greece, which led to the bankruptcy of city-states in the Athenian League: “The city-states of the Athenian League were unable to repay their debts to the temple in Delos” [14].

The fall of ancient Rome is a perfect example of how debt, currency debasement, and inflation can lead to the downfall of an empire and a change in the world order. However, we will delve into that in the next article.

[1] K. Piech, “Cykl koniunkturalny i kryzysy gospodarcze – przegląd keynesowskich i współczesnych teorii ekonomicznych,” published in: Studia i Prace Kolegium Zarządzania i Finansów / Szkoła Główna Handlowa, no. 26, 2002, p. 99.

[2] K. Marks, “Kapitał,” Warsaw 1951, vol. I, pp. 683-684.

[3] H. Verstappen, “Thirty-Six Strategies of Ancient China,” Helion Publishing, Gliwice 2013.

[4] Ibid.

[5] W. Ridgeway, “The Origin of Metallic Currency and Weight Standards,” Cambridge University Press, Cambridge 1982, p. 10.

[6] M. E. Aubet, “The Phoenicians and the West: Politics, Colonies and Trade,” Cambridge University Press, Cambridge 2001, p. 227.

[7] N. M. Noël, “Currencies and Cultures: The Impact of Culture on Economic Policies and the Foundations of Money,” Cambridge Scholars Publishing, Cambridge 2006.

[8] C. Skinner, “Cyfrowi ludzie. Nasza czwarta rewolucja,” Poltext Publishing, Warsaw 2018, pp. 20-21.

[9] M. Morawiec, “Austriacka Szkoła Ekonomii. Jak może pomóc wyjaśnić stagnację gospodarki Japonii,” PWN Publishing, Warsaw 2017, p. 210.

[10] Ibid.

[11] D. Cohen, “W niewoli wzrostu,” Nieoczywiste Publishing, Piaseczno 2016, p. 42.

[12] R. Adamus, “Toksyczny dług XXI wieku,” Difin Publishing, Warsaw 2020, p. 4.